Ethane Carriers

Source: GTTAuthor: GTTRelease Time: 2024-08-07 09:36:18

1. what ethane is?

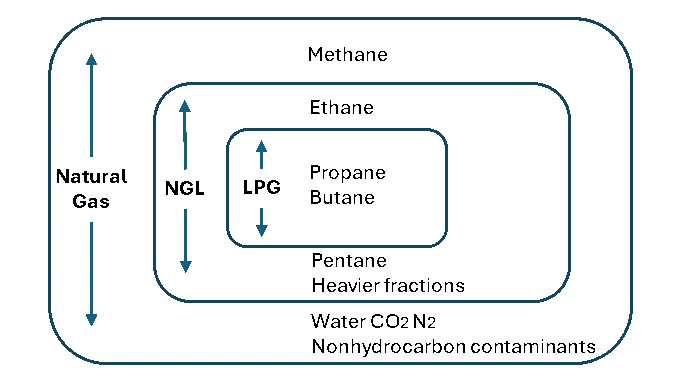

Ethane is a versatile hydrocarbon that can be found on both oil and gas fields and plays a crucial role (among others) in the petrochemical industry, primarily as a raw material for creating a multitude of products that are critical to our modern life. From a chemical point of view, ethane -like methane (natural gas)- is a colorless and odorless hydrocarbon, and it is the second lighter hydrocarbon after methane, it is made up of two carbon atoms and six hydrogen atoms (chemical formula C2H6). Ethane is part of the Natural Gas Liquid (NGL) category, itself between the Liquefied Petroleum Gas (LPG) and Liquified Natural Gas (LNG) categories.

Figure 1: Feedstock categories

When ethane is cooled down to -88 Celsius degrees (-126 Fahrenheit degrees), it changes from gas to liquid. At this cryogenic temperature, Liquefied Ethane Gas (LEG) volume is significantly reduced, facilitating its transportation in bulk. The ethane is in practice never pure, and always contains other gases such as methane, etc… Therefore, its temperature when in liquid form is always cooler than -90°C (-128 Fahrenheit degrees).

Figure 2: Main characteristics of liquefied gases

2. Why is the industry looking for ethane?

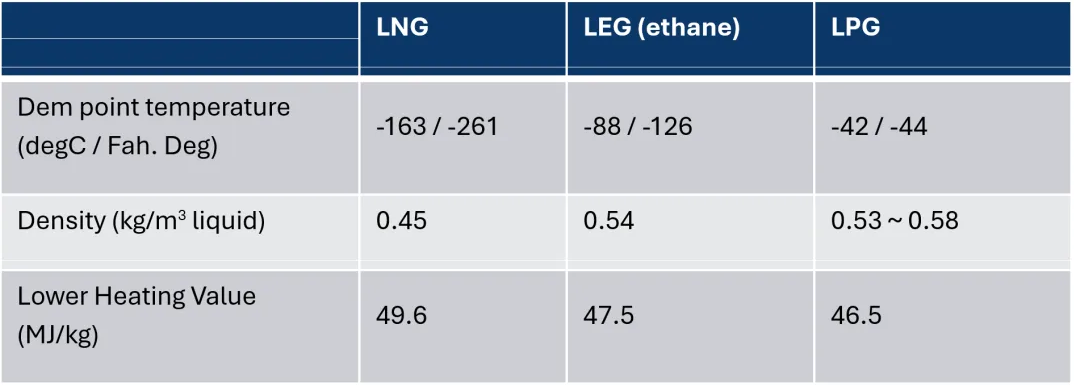

The petrochemical industry uses ethane in several ways:

-

Feedstock for petrochemical processes: ethane is a primary feedstock to produce ethylene, which is a basic building block for a wide range of products including plastics, antifreeze, and solvents. In a process known as steam cracking, ethane is heated to very high temperatures so that it breaks down (or "cracks") into smaller molecules like ethylene and propylene. These are used to make various types of plastics and synthetic fibers.

-

Energy production: ethane can be burnt as a fuel, although it's more valuable as a chemical feedstock than as a source of energy.

Figure 3: Petrochemical basic building block value chain

3. Why is the ethane market booming since 2015?

Before the US shale gas revolution, the ethane market was considered as a low potential trading market and decisions to remove ethane from the natural gas stream were made daily by gas processers, according to ethane prices.

The US shale gas revolution has created a surplus of ethane production which cannot be monetized in the US alone. Several ethane crackers have sprung up near Texas, but ethane remains in significant surplus. This new supply provides opportunities for increased ethane trading between the USA and Europe, South America, and Asia.

Figure 4: World’s first Very Large Ethane Carrier (VLEC) “Ethane Crystal” loading at Morgan’s Point Terminal (courtesy: Enterprise Products)

4. What is the ethane shipping background?

Early ethane transport was dominated by ethylene gas carriers fitted with IMO Type-C cargo tanks. These vessels with a capacity of up to 10,000 m3 and a minority from 10,000 to 36,000 m3, were not the best option to cope with increased ethane export from shale production. Therefore, dedicated ethane carriers (which most of the time can also transport LPG) started to be designed.

Shipping costs are a sizable portion of the value chain. To be more competitive and make new projects viable, new generations of ethane carriers, the Very Large Ethane Carriers (VLECs) have gained attention. These new generations of ethane carriers tend to be larger (87,000 ~ 150,000m3) and more flexible in terms of their range of gas carrying capability, from LPG to LNG, attracting stakeholders from the petrochemical (NGL) and LNG shipping sectors.

Thus, in late 2014, the Indian-based conglomerate Reliance Industries took the initiative of ordering the first of a new generation of ethane carriers fitted with membrane cargo tanks, reaching a total capacity of 87,200 m3. This new breed of vessels is known as Very Large Ethane Carriers, VLECs. The order was placed at Samsung Heavy Industries (SHI).

Figure 5: VLEC Seri Everest built at SHI

5. What are the differences between LNG carriers, LPG carriers and ethane carriers?

LNG is cooler than ethane and its density is lighter. The cargo containment system must at least be adapted to ethane density. One of the cargo containment system makers offers a product that addresses both density and temperature requirements of ethane and LNG. By doing so, the vessel could transport ethane and/or LNG over its 30 years’ service life.

Another major difference is the Boil Off Gas (BOG). BOG is the natural evaporation of liquefied gas when it warms up. Industry players look at Boil Off Rate (BOR), which is the ratio of daily BOG divided by the entire cargo volume (expressed in percentage of volume per day).

LNG carriers are equipped with main engines and auxiliary engines that burn LNG BOG as a means of propulsion or to produce electricity. However, today's engines are unable to burn ethane BOG. Thus, ship owners either burn it in a boiler or gas combustion unit -both ways lead to financial losses-, or “cool it down”. A specific system named a reliquefication unit is necessary to do so. The BOG is injected in gas form, processed, and later reinjected as liquified gas in the cargo tank. This system is a complex engineering process, relatively costly CAPEX and OPEX wise.

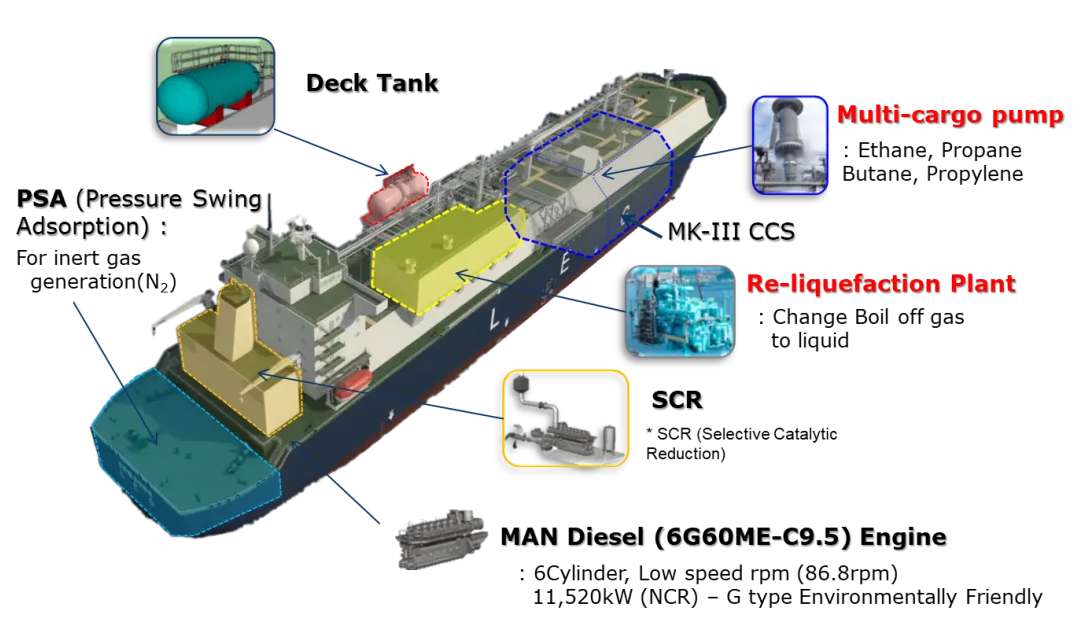

Figure 6: Ethane carrier main equipment and systems.

6. What are consequences of higher BOG?

Any BOG increase leads to additional spending on either CAPEX (larger capacities and/or additional equipment), as well as OPEX over the entire life of the vessel (usually 30 years).

-

Higher BOG means increased capacity of the reliquefication unit, meaning cost increase at shipbuilding stage.

-

Increased capacity of the reliquefication unit capacity means increased of power utility production (OPEX).

-

Increased power utility means larger auxiliary engine capacity (CAPEX and OPEX increase) or service speed slowdown if shaft generator (power-take-out) is used to produce electricity.

-

Slowdown of the service speed means less delivered cargoes and less revenue for the shipowner.

Figure 7: One out of three re-liquefaction system skids for each vessel (Source: Wartsila Gas Solutions)

7. Who are the main shipyards that build such ships?

Nowadays the VLEC market is still a niche market compared to the LNG carrier.

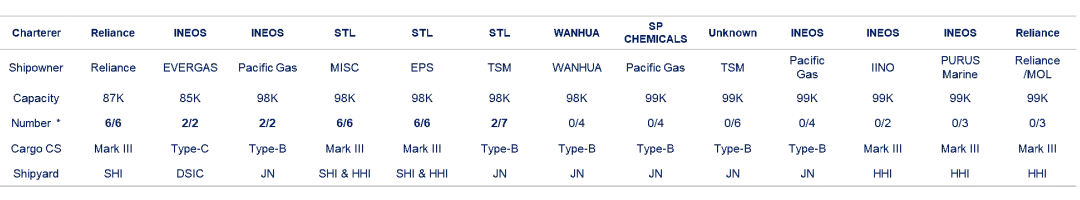

Two South Koreans shipyards have delivered 18 VLECs equipped with GTT Mark III cargo containment system (CCS), Chinese DSIC has delivered 2 VLECs type-C tank and compatriot Jiangnan shipyard has delivered 4 VLECs type-B tank. According to https://www.spglobal.com, 31 more VLEC are in the order book.

Figure 8: Overview of VLEC ordered (delivered and orderbook) as of 2024, April 1st.

Both type-B and GTT membrane cargo containment systems benefit from approximately 50% market share, as the market turned away from type-C tank given the weight even heavier than type-B tank.

Figure 9: VLEC cargo containment systems market share as of 2024 June.

8. What are the difference between these two cargo containment systems?

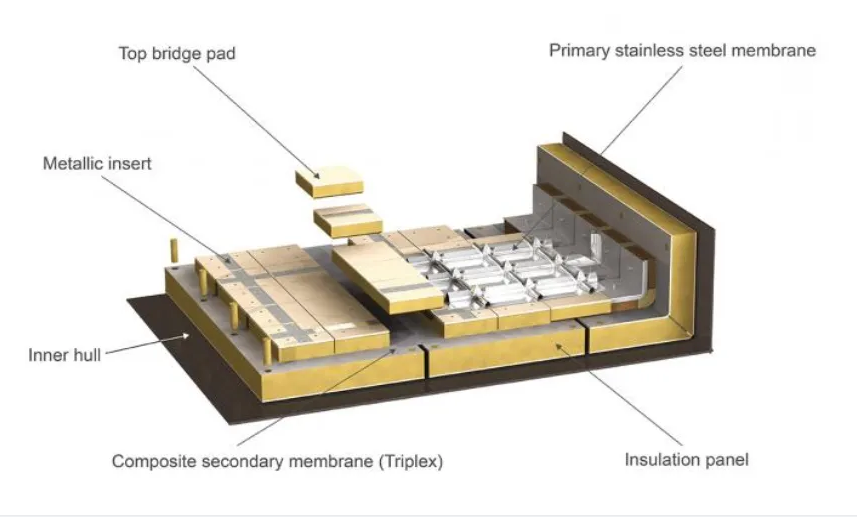

Type-B tank and GTT Mark III cargo containment system are both categorized by the International Gas Code (IGC), who define design and safety standards for the transportation of liquefied gases.

Type-B tank is an independent tank, which is built and then lifted in cargo holds. The tank itself acts as primary containment while the inner hull acts as secondary one. The tank stands on wooden block supports, directly integrated with the ship double bottom structure. The tank is surrounded by an inspection space of approximately 800 mm width. Insulation systems are applied to cargo tank outside walls, made of polyurethane foam panels usually.

GTT Mark III systems is applied like a “wallpaper” to the inner hull of the cargo hold. Industry often refers to “membrane system”. The two necessary barriers requested by the IGC are integrated in the membrane system. The primary one is made of stainless steel S304 or invar, while secondary can be of triplex type (composite material) or invar. The GTT Mark III membrane systems BOG is guaranteed by the maker, which prevents OPEX deviation as well as design capacity mismatches. Meanwhile, it is commonly recognized in the industry that GTT membrane systems offer lower BOG than polyurethane foam panels installed on type-B tanks. Reasons are the convection phenomena in the surrounding inspection space and thermal bridge created by wooden block between cargo tank and double bottom structural elements exposed to sea water temperature.

According to a ship designer study, Mark III cargo containment system weights 1,650 tons, while 5% Ni and Aluminum allow type-B respectively weights 4,000 tons and 5,040 tons. It results in large draft differences. Latest Membrane VLEC draft is at 11.50 meters, while built VLEC using type-B built in China encounters a real draft of more than 12.2 meters. As US ethane export terminals have a draft limitation, the type-B VLEC unfortunately cannot load full cargo to avoid grounding. Reported cargo losses at each voyage is 3,700 cbm.

Figure 10: GTT Mark III cargo containment system created in the 80’s.

9. What are the filling limits of these two cargo containment systems?

The two systems are designed differently on this criterion.

The Type-B tank can be filled at any filling limit according to the IGC code, but in returns face higher sloshing loads and eventually a higher Boil Off Rate.

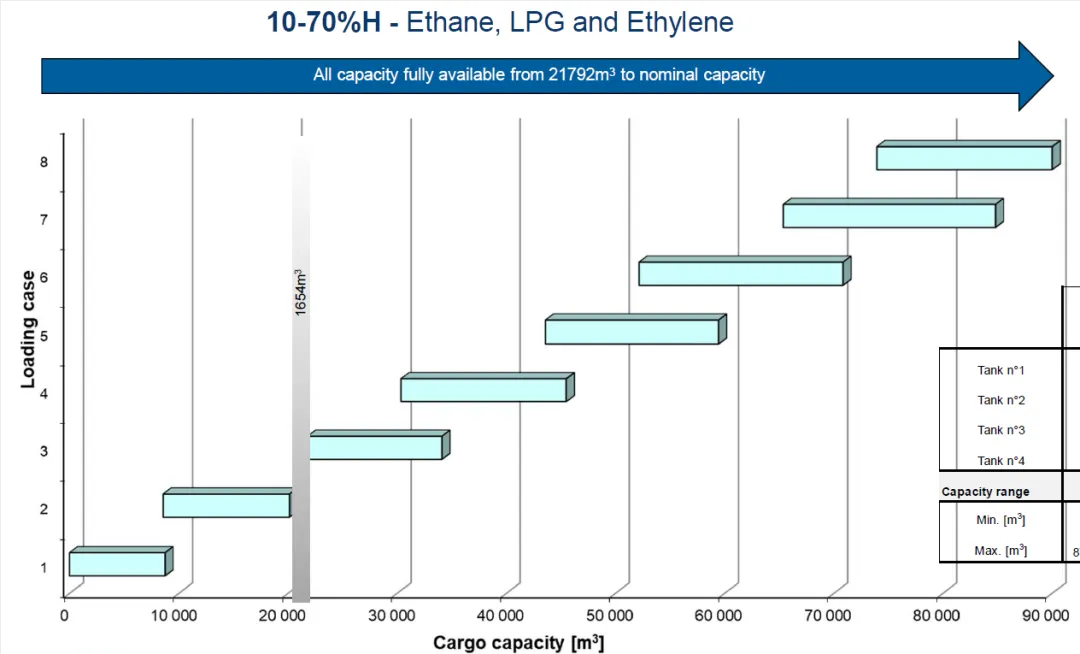

On the other hand, GTT has developed its systems based on operational feedback where gas carriers sail either fully loaded or in ballast condition. By considering such hypothesis, the membrane systems are isolated with low foam density panels, that benefits from low conductivity and eventually offers lower boil off rate. The latest generation of VLEC has a filling limit restriction from 10% to 50% in cargo tank 2/3/4 and 15% to 50% in cargo tank number 1. Such optimization allows the vessel to carry all capacities from 0 cbm to 99,000 cbm with the lowest boil off rate.

Figure 11: All capacity chart for ethane cargo

Early 2024, classification societies’ American Bureau of Shipping and Lloyds Register both granted GTT Mark III containment system with ship-to-ship transfer cargo operations approval in principle. The system is confirmed as a safe and cost-effective solution for the transfer of liquefied ethane but also propane, butane, ethylene, or propylene – regardless of the tank filling level.

Figure 12: Lloyd’s Register Global Segment Director granted VLEC Ship-to-Ship AiP certificate to GTT in Doha

10. Can the two cargo containment systems carry the same cargo type?

VLECs represent a significant financial investment and are exposed to geopolitical uncertainties. Currently, the United States is the sole exporter of ethane, although the UAE has indicated its intention to join the market. Investors are wary of trade scenarios that depend on a single supplier and seek options that offer diversification to mitigate such risks. The industry offers two solutions, which are contingent upon the cargo containment systems in use. A VLEC equipped with a 9%Ni Type-B tank is capable of transporting ethane, ethylene, and LPG, but it is not technically to carry LNG as per the IGC. On the contrary, VLECs featuring membrane containment systems are fully compatible with LNG, which typically commands a higher resale value. Additionally, these VLECs are well-suited for the expanding market of FSRUs, which often require cargo capacities ranging from 90,000 to 150,000 cubic meters, depending on the generation of the FSRU.

11. What are the OPEX differences between VLEC type-B and VLEC membrane?

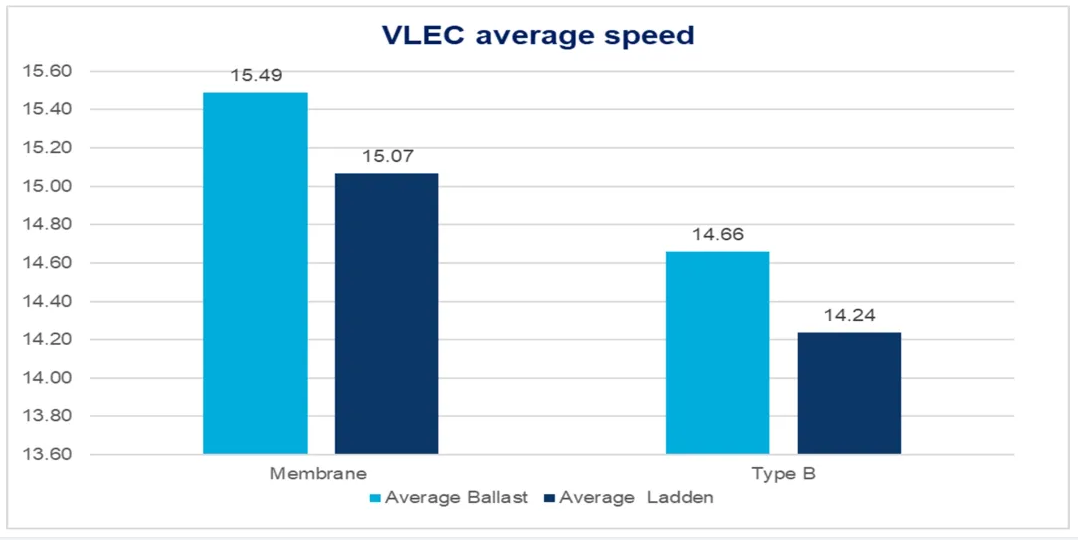

According to online data on from : freshMINT (marketintelligencenetwork.com), membrane VLEC are sailing 0.83 knots faster than type-B VLEC. Such speed difference leads to an additional 0.308 round trip between East China and Gulf of Mexico every year, equivalent to additional 29,974 cubic meters. Considering a mark-up selling price of approximately 100 USD / tons, it is equivalent to more than 3 MUSD additional revenue on yearly basis.

Figure 13: VLEC average speed as per freshMINT data

This significant speed difference is driven:

-

By the power take out from the main engine to run the large capacity reliquefication unit to handle large BOG.

-

By larger draft of type-B vessels due to the cargo containment system additional 3,000 tons weight difference compared to GTT Mark III membrane system.

An additional distinction lies in the intake cargo. Due to their greater initial weight, VLEC equipped with type-B cargo tanks encounter difficulties with draft restrictions when departing from the US export terminal in Nederland, Texas, along the Neches River. This leads to a reduced cargo load for each journey. It has been reported within the industry that this limitation results in a loss of approximately 2,000 metric tons, or 3,700 cubic meters, of intake cargo.

From an economics point of view, the speed and intake cargo differences lead to millions of US dollars revenue every year.

12. In which direction is ethane shipping moving towards?

With the ethane market maturing, there is a growing interest among industry stakeholders in transporting larger volumes of ethane across the oceans. As a result, ship owners are increasingly inclined towards investing in vessels with greater cargo capacities instead of opting for smaller ones. This preference extends to exporters and importers terminal operations as well, who are particularly drawn to Ultra Large Ethane Carriers (ULECs). These larger carriers facilitate increased annual loading and unloading volumes, enhancing production outputs & revenues, as well as emission reduction and attractive ESG goal.

The design specifications of 150,000 m³ ULECs are crafted to align with the operational constraints at both American and Indian terminals.

Figure 14: Double AiP ceremony at CMHI-JS facilities, dealing with the design of 99K VLEC and 150K ULEC equipped with GTT technology and designed by Deltamarin China

Investing in ethane carriers with membrane technology enables the owner to mitigate financial risk, but also penetrate LNG shipping if necessary. Indeed, the asset comes with this dual cargo compatibility, which can perfectly answer market uncertainties. Technically speaking, the conversion from ethane carrier to LNG carrier shall happen at a conversion yard. The main work expected will focus on the main engine tuning, potentially also auxiliary engines, and the reliquefication unit.

The vessels shall preferably be fitted with deepwell cargo pumps, in contrast to the submerged type applied on the first generations of VLECs. Indeed, deepwell pumps are easier to maintain as pump motors are outside the cargo tanks, unpumpable volumes are reduced and multi-cargoes (including LNG) can be pumped without the need of anti-freezing line for grade changing.

English

English 简体中文

简体中文